As seasoned commercial real estate investors, we continuously seek opportunities that offer growth potential in underappreciated markets. Among the array of options in Florida, Palm Harbor commercial real estate presents itself as a distinctive opportunity worthy of deeper exploration. With a robust economy, strategic geographic location, and a burgeoning industrial sector, Palm Harbor stands out as a hotbed for investor opportunities in the realm of commercial real estate.

Understanding the Palm Harbor Commercial Real Estate Landscape

Palm Harbor, located in Pinellas County, is one of Central Florida’s hidden gems, offering a vibrant community marked by economic stability and diverse demographics. Recent data shows that the region has consistently witnessed workforce growth, resulting in increased demand for commercial Spaces. The industrial real estate sector in Palm Harbor has experienced a steady year-on-year growth of about 4%, outpacing the state average, making it an attractive option for investors.

Economic Drivers in Palm Harbor

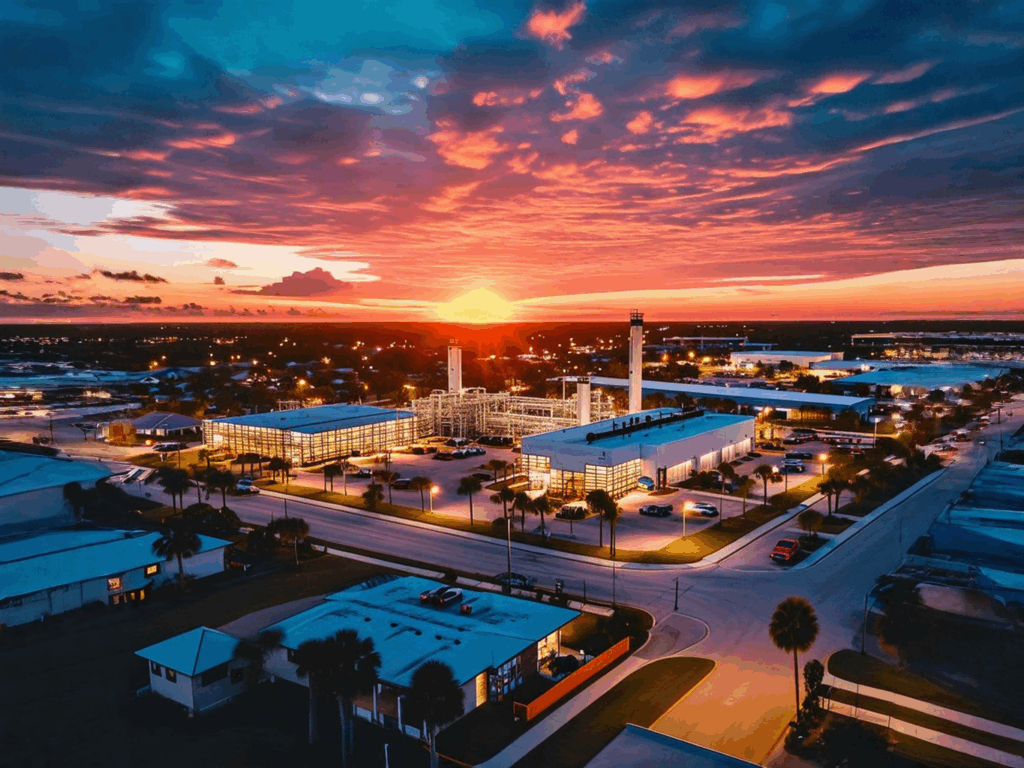

When assessing the viability of any real estate investment, understanding the local economic environment is paramount. Palm Harbor’s diverse economy is bolstered by key sectors such as healthcare, technology, and distribution. Rising average household incomes have led to increased purchasing power, amplifying demand for goods and services. Moreover, the region benefits from a strategic location near major highways, adding to its appeal for logistics and distribution operations.

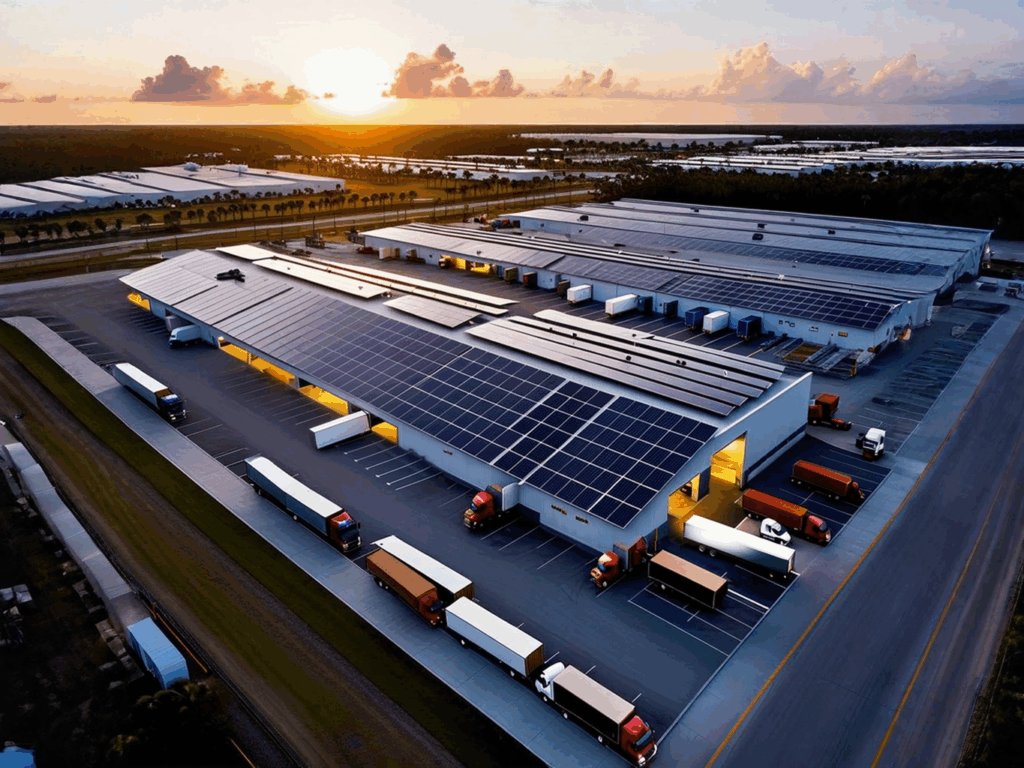

Investor Opportunities in Palm Harbor are further enhanced by a strong focus on sustainability. Recent initiatives encourage eco-friendly industrial developments, positively impacting property values while appealing to a growing demographic of environmentally-conscious consumers.

Key Features of Palm Harbor’s Industrial Real Estate Market

- Low Vacancy Rates: Current data shows that vacancy rates in Palm Harbor’s industrial sector hover around 5%, indicating high demand for existing properties. As competition for available spaces intensifies, investors may anticipate significant returns on properties within this sought-after market.

- Positive Rent Growth: Rental rates for industrial properties in Palm Harbor have consistently risen, averaging increases of around 3% annually. As local businesses expand, the upward trend in rental rates presents a compelling case for future appreciation in property values.

- Development Incentives: Local government initiatives supporting commercial developers enhance the attractiveness of Palm Harbor. Grants and tax incentives aimed at encouraging industrial growth enable investors to maximize their returns while contributing to the region’s economic development.

- Strong Logistics Network: The accessibility of highways, proximity to shipping ports, and supportive community networks favor a thriving logistics and distribution sector. Companies such as Amazon and FedEx have established operational hubs in the vicinity, contributing to increasing demand for industrial spaces.

Investor Strategy Tips for the Palm Harbor Market

- Focus on Flexibility: Look for properties that allow for future expansion or tenant modifications. The demand for adaptable spaces is rising, especially in light industrial and light manufacturing sectors.

- Target Supply Chain Proximity: Invest in sites near major highways and distribution corridors. With companies like Amazon and FedEx operating nearby, being part of this ecosystem increases long-term tenant appeal.

- Leverage Energy Efficiency: Modern industrial tenants are increasingly focused on sustainability. Properties with eco-friendly features—like solar-ready rooftops or energy-efficient HVAC systems—can command premium rents and attract forward-thinking tenants.

- Work with Local Advisors: Market conditions shift quickly. Collaborating with brokers who specialize in Palm Harbor’s commercial sector helps you gain access to off-market opportunities and navigate zoning or permitting nuances.

Analyzing Long-Term Investment Potential

Investing in Palm Harbor commercial real estate, particularly in the industrial sector, offers remarkable long-term potential based on vital market trends. Continuous demand from growing industries combined with the region’s appealing lifestyle makes it a prime location for commercial investments.

Evaluating Risks and Considerations

While the outlook for Palm Harbor is promising, it’s essential for investors to conduct thorough due diligence. Key factors to evaluate include:

- Market Trends: Keeping a pulse on market fluctuations, economic changes, and industry developments is crucial. Regular monitoring of Palm Harbor’s growth trajectory is advised to make informed investment decisions.

- Property Tax Structure: Understanding local property tax laws and potential assessment increases is essential before committing to a purchase. These costs should be factored into financial models to ensure long-term profitability.

Final Thoughts

Palm Harbor’s industrial real estate market offers strong potential for investors looking to grow and diversify their portfolios. With low vacancy rates, steady rent increases, and ongoing development support, the area presents a compelling case for long-term value. For those exploring new opportunities, Palm Harbor stands out as a market worth serious consideration.

If you are ready to dive deeper into Palm Harbor commercial real estate, don’t hesitate to reach out today. Contact Florida ROI for expert guidance and tailored real estate solutions. The time to act is now—don’t miss your chance to secure your share in this burgeoning market.

Frequently Asked Questions

Q: What are the current trend forecasts for Palm Harbor commercial real estate?

A: Current forecasts predict continued growth, with low vacancy rates and rising rents in the industrial sector, making it an attractive investment landscape.

Q: What types of industrial properties are most sought after in Palm Harbor?

A: Distribution centers, warehousing, and light manufacturing facilities are in high demand due to the region’s strong logistics framework.

Q: Are there any government incentives for industrial development in Palm Harbor?

A: Yes, local government initiatives provide grants and tax incentives aimed at fostering industrial development, enhancing the appeal of investments.

Q: What is the average rental yield in Palm Harbor’s industrial market?

A: Average rental yields in Palm Harbor typically range between 6-8%, depending on property type and strategic location.

Q: How can I stay updated on Palm Harbor’s commercial real estate trends?

A: Engage with local real estate associations, subscribe to industry reports, and consult with local professionals for the latest insights and trends on the market.