Ok, So I am a computer and data geek? What can I say? Since the time I was young, I had trouble recalling names, places and what I did the day before, but I sure as heck could recite names, numbers and statistics of the Miami Dolphin’s 1972 football team. I also loved to use sports stats and trends to try to predict who was going to have a break out season the next year.

Well, not much has changed. As I move (ungracefully, I might add) in to middle age, as a Commercial Real Estate Broker, I still love looking at and searching for that number or statistic that might provide a clue as to where we are headed before the economic data tells us where we have been. I recently found this tool on Google Finance. It allows you to track relative Google searches in specific sectors of the economy. It does not track the specific number of searches, but rather those searches in relation to the entire Google network.

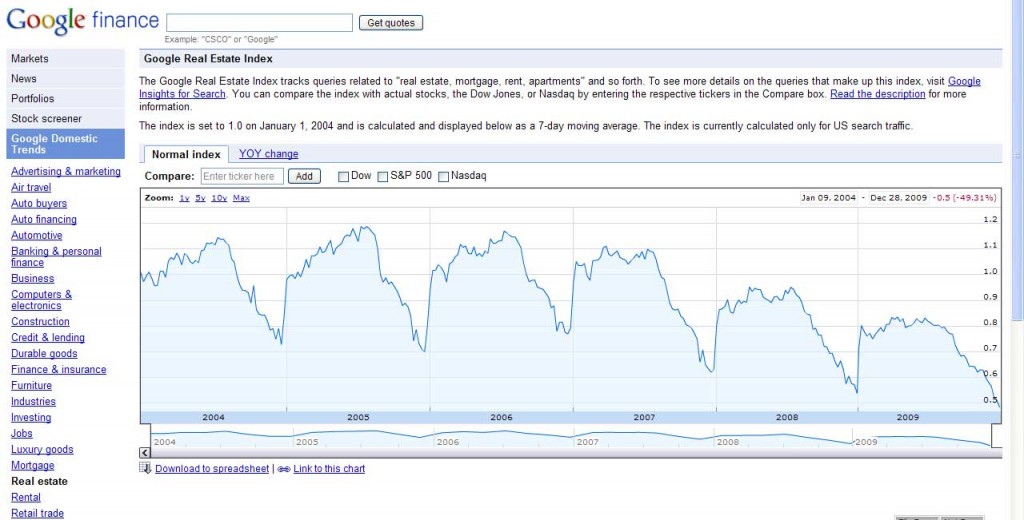

Here is a graph in relation to real estate searches:

A couple of things jump out, besides the fact that relative real estate searches have decreased substantially since the peak of the real estate bubble. Relative searches for real estate drop off the face of the earth after the first week of August. Unsurprisingly, this reveals to me the disproportionate number of look-ups for residential real estate as compared to commercial. The number of real estate sales are skewed to the residential side and residential sales taper off after school starts in August. Commercial sales tend to follow economic trends and year end tax selling or buying, rather than when little Johnny or Sally start school. (I won’t even get in to the fact that most of the commercial real estate industry has been dragged kicking and screaming in to the Internet age, and in the CRE world, the Internet still has not gained even a fraction of the traction compared to that the residential real estate world.)

But, we can absolutely deduct that there is some correlation between the residential and commercial markets. It is easy to reason that if residential buyers are out looking for second homes, newer homes or investment homes, there will also be a spill over in to interest in commercial investment properties (strip centers, single tenant net-lease deals, multi-family, etc). The two types of sales are not necessarily mutually exclusive and completely detached from one another.

Anyway the point is, if Google reports a relative increase in real estate related searches, it is reasonable to draw a conclusion that sales of real estate will in all likelihood follow. And, if it is an accurate assumption, Google may be one of the leading indicators of real estate sales and activities. I will revisit this tool over the next several quarters and see if there is in fact any correlation.

I would also love to see Google tweak this tool. You can make comparative graphs on the tool currently, if there is a corresponding Google symbol for the subject data. But, it would be nice to break out commercial real estate against residential. It would also be nice to break out the commercial real estate sectors (such as retail, industrial, etc.) or regions (Miami or Orlando, versus the Tampa Bay area commercial real estate markets) and to my knowledge there are currently no symbols to identify these data descriptors.